FINANCIAL COACHING

Financial Resources

Housing Assistance

The City of Charlottesville and Albermarle County offer several options for emergency financial assistance.

See HERE for financial assistance with rent payments.

See HERE for financial assistance with utility payments.

Homeownership and Mortgages

Paying a mortgage is an important part of homeownership. If you are struggling to pay your mortgage, or are concerned about missing a payment, you should contact your mortgage servicer as soon as possible. You may qualify for financial relief options.

See HERE for resources on getting a mortgage and maintaining a mortgage.

See HERE for Bankrate's tips on calculating an affordable mortgage payment for your family.

See HERE for information on mortgage relief options.

See HERE for information on Charlottesville and Albermarle County mortgage assistance programs.

See HERE for information on property tax assistance in Charlottesville.

Foreclosure Assistance

If you are concerned about foreclosure, you should contact your mortgage servicer as soon as possible. Additionally, you should contact a HUD-approved housing counselor to receive free, professional assistance on avoiding foreclosure.

See HERE for a checklist on how to avoid foreclosure.

See HERE for a list of HUD-approved housing counseling agencies.

Managing Credit and Paying off Debt

Managing your credit and paying off debts can give you more financial freedom.

See HERE for a video on steps to help get out of debt.

See HERE for a video on strategies for paying off debt.

Contact your bank - Many banks offer a wide range of helpful information, interactive tools, and strategies designed to help you reach your financial goals: Wells Fargo, Bank of America, and Union Bank & Trust all offer assistance with some credit issues and improving credit if you have an account with them. Call your branch for more details or visit their website.

Types of Debt

- Secured vs. Unsecured - For information on secured and unsecured loans, click HERE.

- Credit Cards - For information on managing credit cards, click HERE.

- Medical Debt - For information on medical debt, click HERE.

- Student Loans - For information on repaying student loans, click HERE.

- Auto Loans - For information on auto loans and buying a car, click HERE.

- Payday Loans - For information on payday loans, click HERE.

- Cosigning Loans - For more information on cosigning loans, click HERE.

Calculating Your Debt-to-Income Ratio (DTI)

Debt-to-income ratio (DTI) divides the total of all your monthly debt payments by your gross monthly income. The following websites have more information about understanding and calculating your DTI.

- Nerd Wallet - offers financial tools and objective advice to help people make informed decisions.

- Wells Fargo - Wells Fargo Smarter Credit TM Center offers news, perspectives, and tips for credit management.

Other Helpful Websites

- To obtain a free copy of your credit report, click HERE.

- To obtain a copy of your tax transcript, click HERE.

- Feed the Pig - provides helpful tips for managing finances.

- SmartyPig - provides savings opportunities.

- EveryDollar - a phone app that allows you to track spending.

- The Financial Trade Commission (FTC) - provides resources on credit, debt, homes, jobs, making money, and more.

Professional Assistance

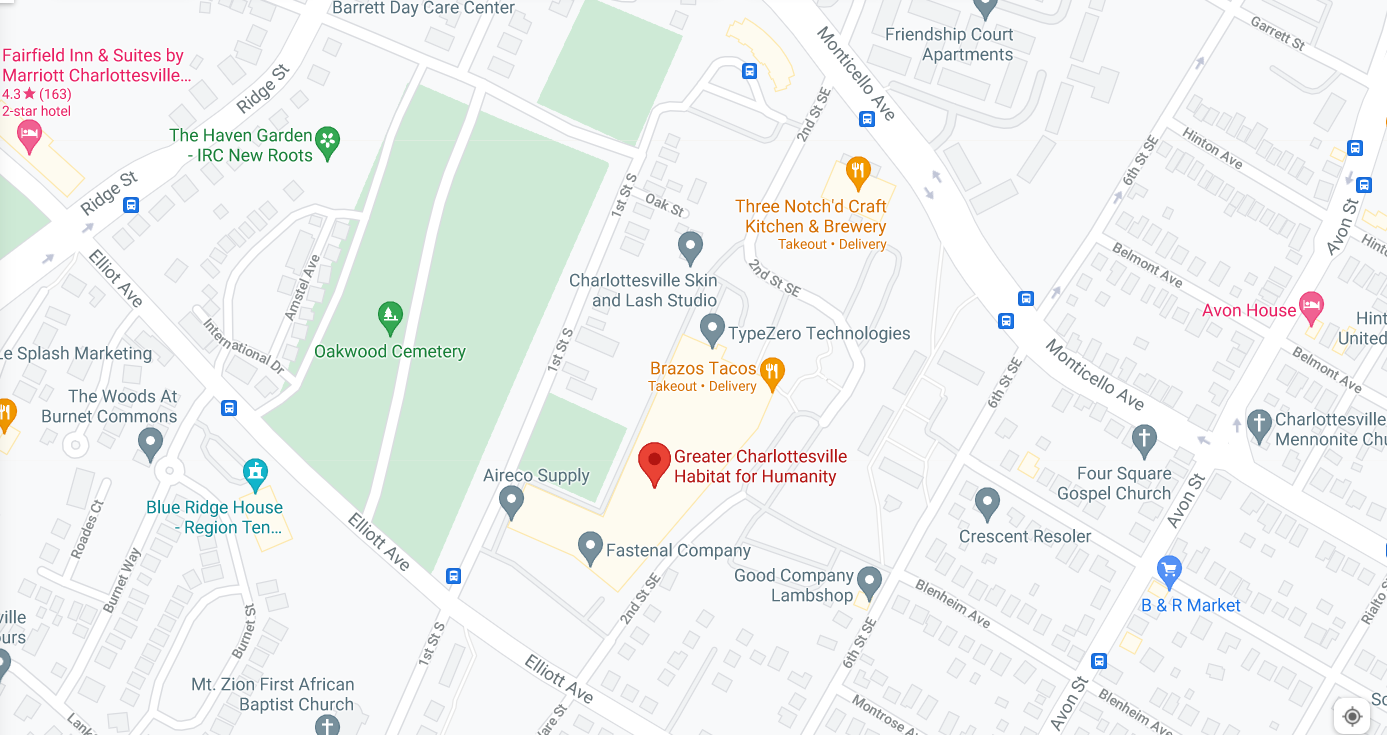

- Habitat for Humanity - Contact one of our financial coaches for assistance creating a debt management plan.

- Piedmont Housing Alliance (PHA) - Provides financial and credit counseling, as well as rental counseling and fair housing resources to area residents. Click HERE or call (434) 817-2436 to access PHA's services.

- New Hill Development - Provides financial education and homebuyer counseling to area residents. Click HERE or call (434) 220-8072 ext. 115 to access their services.

- Charlottesville Abundant Life Ministries - Provides personal finance classes to area residents. Click HERE or call (434) 970-2077 to access their services.

Negotiating with Creditors and Debt Collectors

The creditor is the company that originally provides you with the credit or loan. Negotiating with creditors can help to lower your rate or repayment plan.

Debt collectors are third party companies that have been hired to collect your debt. Debt negotiations with creditors and debt collectors can also help to avoid garnishments, judgments, foreclosure, and bankruptcy.

See HERE for a video on negotiating with creditors.

See HERE for information on negotiating a settlement with debt collectors.

Unemployment

You can file for unemployment benefits by completing an online application or by calling 1-866-832-2363 to get started.

See HERE for instructions to apply.

See HERE for a video on how to apply.

Click HERE to file for unemployment online.

Public Assistance

If you are experiencing financial difficulty, you might qualify for benefits through the state of Virginia. You can apply to public assistance programs including:

- Food stamps (SNAP)

- Cash assistance (TANF)

- Utility assistance (LIHEAP)

- Medical assistance

- Child care

Click HERE to apply online or call 1-855-635-4370 to get started.